Introducing a universal basic income (UBI) would give a huge jolt to the U.S. economy, according to a new analysis, one of the first to consider the wider effects of giving everyone in the United States a regular, unconditional cash payment to meet their everyday needs.

UBI has been winning a lot of supporters recently, notably among tech figures like Elon Musk and Mark Zuckerberg. It is often touted as a solution to technological unemployment, though there are plenty of other rationales, including a desire to streamline government and to give individuals more autonomy over how they spend their money.

The new analysis, from the left-leaning Roosevelt Institute, considers three main scenarios: paying every adult $1,000 a month, paying all adults $500 a month, and paying $250 a month just to kids (a child allowance). In all cases–including different ways of paying for an UBI–the impact would be positive, economically speaking, the analysis says. If kids received $250 per month, GDP would grow 0.79% per year over an eight-year period; $1,000 for all adults would expand the economy by a whopping 12.56% over the same time frame. That would mean at least $2 trillion in additional wealth as the spending feeds down to businesses and individuals.

Marshall Steinbaum, Roosevelt Institute’s research director, says the effect comes mostly from increasing consumer demand. The think tank argues that the economy is sluggish because people on middle and lower incomes aren’t earning enough money relative to inflation. Economic growth is going disproportionately to higher earners who are more likely to save than lower earners, who tend to spend more of whatever they have left. “It’s like buying a yacht. Saving is something that rich people are more likely to do,” Steinbaum, who coauthored the paper, says in an interview.

Steinbaum is not a fan of the automation argument for UBI. But he does think UBI could help workers to win better wages when they work. Like other left-of-center economists, Steinbaum argues that wages are stagnating not so much from business or economic factors, but rather because of power dynamics between employers and employees. UBI would give workers more voice, he says.

“The absence of job opportunities means employers can benefit at the expense of employees by reducing wages and benefits. If you make benefits not conditional on having a job, that increases workers’ bargaining power because they’re supporting themselves separately and they’re not dominated and manipulated,” he says.

While economists agree that giving people money tends to increase consumer spending and therefore economic growth, the assumptions underlying the paper are sure to be controversial. For one, it assumes that people will continue to look for work despite having other income (in line with research from another Roosevelt-affiliated researcher, Ioana Marinescu). For another, it assumes that higher taxation to pay for UBI wouldn’t affect how households spend their money. That contradicts a key tenet of modern conservative thought, which says cutting taxes increases spending.

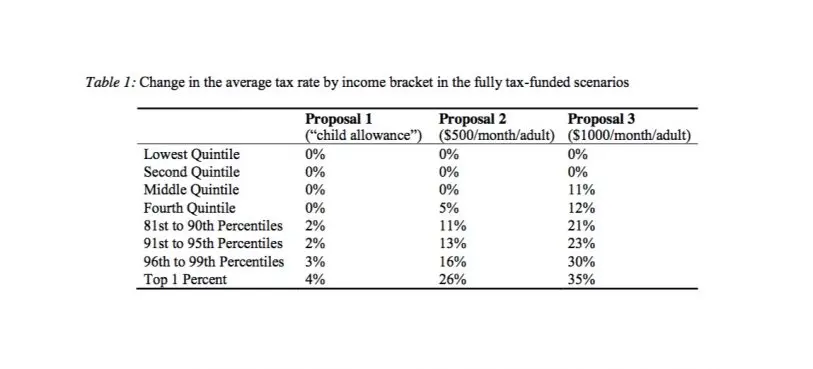

The tax implications would be enormous. To pay for the $1,000-a-month scenario would see additional taxes on the top 1% of earners of 35% and those in the top quarter of 12%. The alternative would be simply to add to the public deficit, or, more likely, shift public spending around. Andy Stern, former president of the Service Employees International Union, has proposed axing existing antipoverty programs, which cost about $1 trillion a year, including food stamps ($76 billion a year), housing assistance ($49 billion), and the federal Earned Income Tax Credit ($82 billion). Conceptually, the question is whether UBI is a replacement for the traditional safety net, or something more substantial. Some see UBI as an investment that allows people to leave behind tedious, repetitive work in favor of more fulfilling, creative activities.

Frankly, the kind of changes envisaged by Roosevelt and Stern don’t seem likely in the short term, whatever the economic effects. But smaller-scale UBI trials are underway, including in Oakland, California; Kenya; and Finland, and, assuming positive results, they may help build momentum for the idea over time. (Hilary Clinton says in her recent book that she almost ran on basic income in 2016, calling for an expansion of Alaska’s Permanent Fund Dividend nationally–a policy she calls “Alaska for America.”)

Steinbaum likes a UBI most of all because it’s unconditional. You don’t have to work, or have children, or adhere to any set of social guidelines to get one. “It means you don’t have to have a job or be a parent or living in the right places. It’s universal and unconditional for all and that would represent a major redistribution of power in the economy,” he says.

Recognize your brand's excellence by applying to this year's Brands That Matters Awards before the early-rate deadline, May 3.