Let’s get this out of the way from the very beginning: Driverless cars are not coming off the assembly lines in Detroit and Tokyo anytime soon. As much as Elon Musk and Sergey Brin are convinced that human drivers and the ills that plague them will be relegated to a minor prelude to the robot-chauffeured future, both tech doyens are in the business of selling you a rose-tinted tomorrow, today.

In reality, the current autonomous landscape is much murkier, full of labyrinthine bureaucratic bulwarks and apprehensive consumers who may actually enjoy driving or at least enjoy a bit of increasingly rare personal agency. Even engineers, people who will eventually serve as ambassadors to our robot overlords (and who may be at least partly responsible when something goes wrong), are anxious about autonomous vehicles performing tasks like picking children up from school. So no, your car will not be your mobile living room anytime soon.

That isn’t to say that tech firms are biding their time for a zero to one jump that will change the auto industry forever. Cars and roads are going to get a lot smarter in this interim period, and the future of transportation won’t solely be dictated by giants like Google and Uber. Instead, companies that are focused on vacuuming up every available data point associated with driving will dictate the dialogue—and lucky for them the average car spits out hundreds of thousands of bytes of information every day.

These developments will likely bear fruit for cities no matter when robots start shuttling us around. In fact, they’re already smarter than you might think. For the last few decades, most of your driving has been monitored. Telematic diagnostic devices like General Motors’ OnStar funnel gigabytes of data back to the manufacturer, while Progressive Insurance’s Snapshot usage-based insurance device relays speed and location data to the company’s headquarters.

Meanwhile, the ubiquity of EZ-Pass and other toll transponders give planners an idea of average speed between defined points; companies like Inrix are patched into massive CCTV camera networks that use computer vision and good old-fashioned eyeballs to provide real-time data on traffic movement; publicly funded programs like NYCDOT’s “Midtown in Motion” monitors travel speeds and responds by altering the signaling system in a defined 110-block area that tends to be the city’s most congested.

Related: The Future of Autonomous Vehicles Relies On Middle America

As much as the aforementioned programs seem like another set of holes in the Swiss cheese facade of urban privacy, these sorts of tools have long been geared toward helping traffic planners make roadways flow efficiently rather than, say, keeping an eye on where motorists are going. That’s changing, though, and a new set of firms is interested in capitalizing on driver behavior with an eye on the future of transportation.

“Data has become a huge blind spot in the development of driverless cars,” says Jamyn Edis, cofounder and CEO of New York-based startup Dash Labs. Edis’s firm was originally conceived as a “Fitbit for your car,” which, in exchange for letting Dash Labs track their driving data, would give drivers real-time feedback about their performance and detailed information about their vehicles. Soon however Edis found that the data his team collected had much larger implications for driverless technologies, and realized that the company was much more valuable as a data platform that could help institutional clients like parts manufacturers, fleet managers, and logistics firms improve their business operations.

“We’re taking data straight from the ‘cerebral cortex’ of the car”— the “Controller Area Network” bus or “CANBUS”— “and pairing it with smartphone sensors and driver info,” Edis told me via email. “This is the data that will be used to train the algorithms and machine learning capabilities that self-driving systems will need. We’re in the business of ‘feeding the machine.'” Luckily for Dash, the machine seems to be insatiable.

Unlike Google, Dash depends on a constant stream of user-generated data to train machine algorithms to make better decisions. “It’s akin to the approach Nvidia is taking—i.e. using human drivers to generate data for their self-driving AI—rather than the sensor-first approach of Waymo,” says Edis.

Related: Self-Driving Cars Must Earn Our Trust, Says Intel’s Autonomous Chief

“As a benchmark, Waymo’s cars just tipped 3 million miles after seven years,” he adds. “Our system logged data at a rate 50 times faster.” (For what it’s worth, Waymo is doubling down on the sensor approach through its secretive “Carcraft” project where engineers are training test vehicles to deal with particularly difficult situations on a test track in California’s Central Valley.)

Dash is competing in a crowded marketplace, though it remains to be seen whether competitors like Automatic, recently purchased by SiriusXM for over $100m, will shift their focus from consumers to constructing a platform as Edis has. (Recently, in a bid to counter-balance Uber’s well-capitalized autonomous efforts and foster its own, Lyft announced it would offer Google’s robot car researchers some of its driver data.)

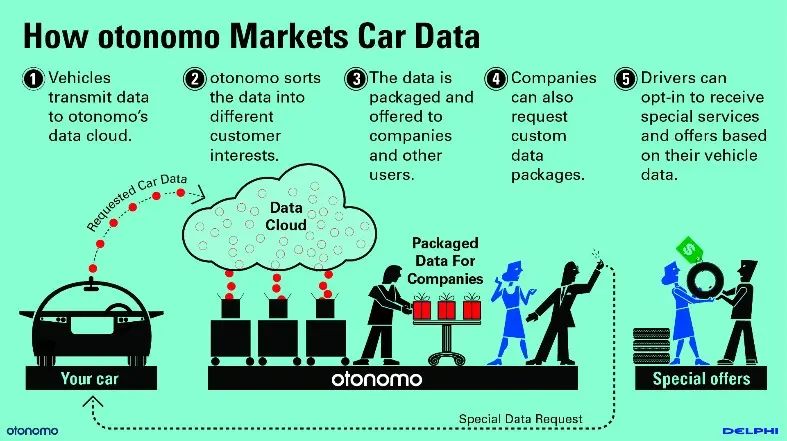

Another well-funded startup, otonomo, has made inroads with auto manufacturers interested in harnessing the firehose of data created by passenger vehicles. Modern vehicles already generate upward of 25 gigabytes of data every hour and Americans spend an average of 290 hours behind the wheel every year; parsing that massive influx of information is where otonomo has found considerable opportunity.

“Until today, connectivity was a pain for OEMs,” says Yael Rivkind, partnerships manager at otonomo. “They invested in installing a modem, data transmission, and storage. Our platform lets OEMs capitalize on previous connectivity investments and unlock a new source of recurring revenue from data-enabled services.”

Already some manufacturers are leveraging built-in telematics technology—General Motors’ OnStar has been around for two decades, Hyundai’s Blue Link launched in 2014—and telecoms have spent big as well. Last year, Verizon spent $2.4b to acquire Fleetmatics in a move to carve out a significant piece of the connected car landscape for itself. Firms from across the map are well aware of the gold rush at stake: A study by Navigant Research projects the consumer market for telematics-equipped vehicles to grow from 100 million to 450 million by 2025.

Alternate Routes: Open And Closed

The impacts of corralling one of the last frontiers of Big Data have the potential to be felt across other industries as well. Insurers like Progressive and Allstate are using usage-based insurance to reward low-risk customers in real-time, a notable shift away from the demographic and financial analysis that has dominated the industry for decades. Waze is effectively crowdsourcing traffic planning, collecting data that city planning agencies can only dream about and shifting demand for roads instantaneously. And, at the bleeding edge, lvl5 is attempting to crowdsource HD-quality maps with an astounding level of granularity using computer vision.

It’s not just Silicon Valley that’s interested in the burgeoning market for automobile data. Ericsson, the Swedish telecom giant, announced a Connected Vehicle Platform back in February. Bosch, the German technology conglomerate, has also announced a colossal initiative where they’ll pair up with TomTom to create “a ‘radar road signature’ that “can help position cars in their surroundings to within a few centimeters.” (Ericsson and Bosch have both invested heavily in several smart car startups; Delphi, the auto parts behemoth, also led otonomo’s $25m series B fundraising round, an investment that will no doubt open some doors in Detroit.)

And then there’s Apollo, the self-driving car project from Chinese tech giant Baidu. While Uber, Google, Apple, and Tesla are all in the race to be first to market with a proprietary self-driving vehicle, Apollo has brought over 50 of the world’s leading technology, communications, and logistics firms together to build open-source autonomy. Baidu, like Hotz’ Comma, is focused on open sourcing the driverless car. (Yes, the Android vs. iOS argument applies here as well.) Apollo’s charter members include firms that touch on every aspect of the autonomous galaxy including Bosch, Nvidia, TomTom, and Microsoft. (They’re also partnering with Chinese auto manufacturers like Chery, Changan, and Great Wall Motors as well as several Chinese universities and government bodies.)

While Baidu has a “stated goal of releasing a driverless car by 2018 with mass production to begin by 2021″ it’s clear the Chinese company is interested in analyzing data massive datasets in an open environment, something that differentiates Apollo from its closed system competitors. By collecting data from heterogeneous sources, the Apollo project is hoping they can beat Google, Uber, and Tesla to the driverless punch. (Toyota, Ericsson, and Intel also recently joined forces to create a ” connected car data consortium ” aimed at cornering the Japanese intelligent car market. Japan’s government is moving relatively quickly in creating standards for the development of autonomous vehicles.)

“Data is the new oil,” says Dash’s Edis, before adding that he doesn’t believe the information race needs to be a zero-sum game, and it shouldn’t be. “Maps and real-time sensor array data need to be constantly refreshed,” he says, “So the more input—from companies large and small—the safer we can hope for the future road to be.”

Otonomo’s Rivkind agrees. In order for Detroit to compete with the Valley, he says, “there is a need for a platform that will aggregate data from multiple OEMs and provide a more comprehensive data set to interested parties from auto insurance providers to retailers for location-based services.”

We seem to have a pair of on-ramps ahead of us, then. Google, Uber, and Tesla have focused their energies on becoming first-to-market with a proprietary driverless car. Put simply, their goal is to shift Detroit to Silicon Valley, shedding the pathologies—and unions—that plagued the auto industry for decades in the process. There’s no doubt that they’re making progress toward autonomous vehicles, but even otonomo’s Rivkind believes we won’t see a mass market driverless car until “2030, once regulatory liability and technological issues have been resolved.”

A cautionary tale about regulation can be found in George Hotz, the hacker wunderkind who began offering a DIY driverless car kit called “Comma.ai” last year before receiving a stern letter from the National Highway Transportation Safety Administration warning that “some drivers will use [Comma] in a manner that exceeds its intended purposes” and threatening Hotz with severe fines if he didn’t provide documentation related to federally required safety equipment.

Related: The Federal Government Wants To Help Clear Up Self-Driving Car Confusion

Hotz shut down the project following the letter, only to reboot it as an open-source connected car platform aiming to be the “Android” to Tesla’s “iOS.” (Hotz and Musk have a long-running feud over what the self-driving car landscape will look like in the coming years.)

The lesson: the feds are keeping a close eye on developers who would attempt to skirt traffic safety laws. Last week, the U.S. House of Representatives passed legislation that aims to regulate autonomous cars at the federal level, and this week, the Dept. of Transportation will release its first self-driving guidelines. Despite possible exceptions to state safety rules in the House bill, roads aren’t a market flaw to be disrupted. Mistakes, no matter how minor, can very easily lead to casualties.

Still, the firms and groups that are exploring an alternative route that has more in common with open source philosophies are interested in what happens before we take the driver out of the equation. There’s a chance this “open” development may lose the race, but there’s also a potential that this path will yield an industry that rewards innovation and develops standards in line with consumer desires and needs.

A relevant albeit boring parallel can be found in the way the usage-based insurance market developed. When auto insurers developed their benefit algorithms, they did so in silos and in the process ensured customers wouldn’t be able to take the data they generate to shop for better rates. There’s a hope that platforms like Dash, otonomo, and the like could lead the way to developing those standards and put the power back in the hands of drivers. Only time can tell which direction driverless cars will take, but it’s clear the bridge that gets us there will be built, somehow, on the back of lots of data.

Recognize your brand's excellence by applying to this year's Brands That Matters Awards before the early-rate deadline, May 3.