Another day, another round of attention-grabbing headlines about SoftBank, the Japanese financial giant and the tech world’s biggest investor.

The company’s ambitious chairman, Masayoshi Son, told investors after an earnings call this morning that he’s interested in investing in either Uber or Lyft, the dueling ride-hailing companies. And he’s reportedly maneuvering to have Sprint, the telecommunications giant that SoftBank controls, attempt a takeover of cable giant Charter Communications. Last week, SoftBank reportedly invested $250 million in Kabbage, which the small-business lending startup plans to use to expand its reach in the United States. And the previous week, it was reported that SoftBank was leading a $1 billion funding round for Chinese bike-sharing startup Ofo and had invested in Singaporean ride-hailing company Grab in a $2.5 billion round.

They’re just the latest examples of SoftBank’s aggressive strategy of making big bets on the technologies and business models of the future, from artificial intelligence and robotics to ride-hailing and fintech.

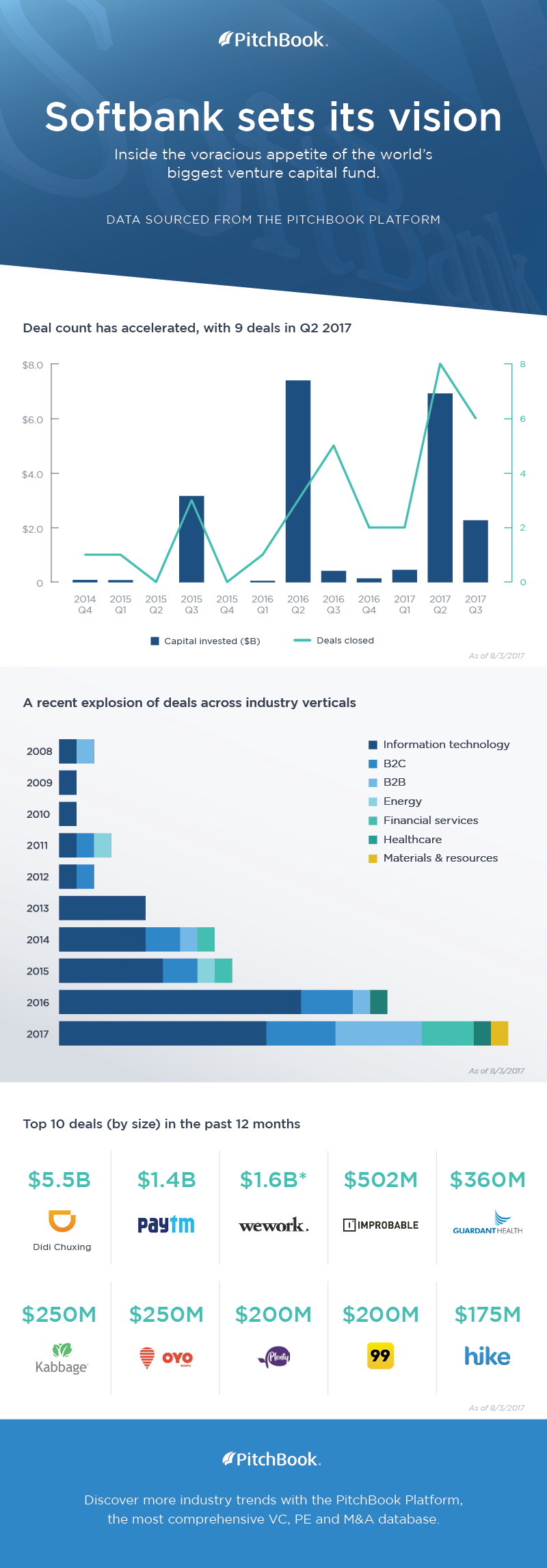

This year, SoftBank has been on a tear, investing more in just the second quarter of 2017 than in all of last year combined ($8.35 billion compared to $7.94 billion), according to a PitchBook analysis prepared for Fast Company. And it’s already invested more in the first three weeks of the third quarter of 2017 (over $2 billion, not including the Ofo deal) than in all but two quarters over the last three years. Much of this new investment is due to SoftBank’s much-heralded $100 billion Vision Fund–the largest tech-focused fund in history–with high-profile backers like Apple, Qualcomm, Saudi Arabia’s public investment fund, and Foxconn, among others.

Since first disbursing its funds this spring, the Vision Fund has invested in robotics firm Brain Corp. and agtech startup Plenty, whose indoor farms promise to produce “hyper-organic food with no pesticides nor GMOs while cutting water consumption by 99%,” according to CEO and cofounder Matt Barnard. It’s the kind of visionary startup favored by SoftBank’s Son, who said Plenty will help “remake the current food system.”

Though the financial powerhouse has been extremely active in recent months, intense focus on tech has always been in its DNA, say analysts. “SoftBank has had a history of investing in pivotal technology players expanding markets for communications, which is perfectly in line with their original mission and scope of expertise,” says Tom Hackenberg, an analyst at IHS. He notes that SoftBank formed as a telecom company back in 1981, invested in computer expo pioneer Comdex in 1985, mobile giant Vodafon in 2006, and video streaming service Ustream in 2007.

“As you might notice, SoftBank has employed a successful vision of where next generation communications services are going,” adds Hackenberg. The size of the investments is welcomed by most investors, but some venture capital firms have expressed concern that they’ll be priced out of new startup funding rounds, reports Business Insider.

The variety and heft of the investments has convinced Patrick Moorhead, the president and principal analyst of Moor Insights & Strategy, that SoftBank “is trying to put together literally the ecosystem of the future.” He adds, “If you go 10 years out, what is the future going to look like? And where is the heat? Where are people going to be selling things, where are they going to be making money? That what they’re focused on.”

With investments in telecom companies like Sprint, chip designers like ARM, as-a-service platforms like Ofo and Grab, and robotics firms, SoftBank has taken a holistic approach, says Moorhead. “The only piece of the pie that I don’t see is data centers, those that you need to do deep learning.”

To get a sense of the sheer size of SoftBank’s Vision Fund, consider that it’s four times bigger than the largest private equity buyout fund ever raised: Apollo’s new $24.6 billion buyout fund, says Nizar Tarhuni, analyst manager at PitchBook. The sheer size of the fund means that it won’t get into too many early-stage venture markets, “given the larger check size it needs to write for each investment to make its fund economics work.”

Tarhuni expects SoftBank to keep making big bets across entire sectors like VR, IoT, fintech, and AI, with its main focus on later-stage startups or public companies. “This strategy allows them to bet on platforms, as opposed to just select companies within sectors, which lends itself to a much more thematic and macro investment theme that could be promising over time.”

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.