After just five months in office, the Trump Administration has pulled us out of the Paris climate agreement, proposed deep cuts in research and development for electric cars and renewable energy, and made numerous anti-climate appointments at the Environmental Protection Agency, Department of Energy, and Department of Interior. Trump’s entire agenda seems designed to help fossil fuel companies at the expense of the clean-energy sector.

For anyone who cares about global warming and a less-polluted world, these are surely depressing developments. But there are silver linings. The role of governments–even a government as big and as powerful as the United States’–may not be as important to the future of energy as it once was. Investment in renewables continues to outpace those in fossil fuels two-to-one. The economy is growing and emissions aren’t. And solar and wind are set to become cheaper than coal just about everywhere (if they haven’t already). As Bloomberg New Energy Finance (BNEF) chairman Michael Liebreich likes to say, solar and wind aren’t “alternative” forms of power anymore. They’re mainstream, and they’re coming to the fore just as we need them most.

BNEF’s annual New Energy Outlook takes account of these trends and makes predictions for solar and wind that once would have been incredible. It notes that the cost of electricity from solar PV has fallen by almost a quarter since 2009 and is set to fall another 66% by 2040. It says solar power is already as cheap as coal-derived electricity in Germany, Australia, the U.S., Spain, and Italy. By the beginning of the next decade, it says it will be cheaper than coal in China and India as well.

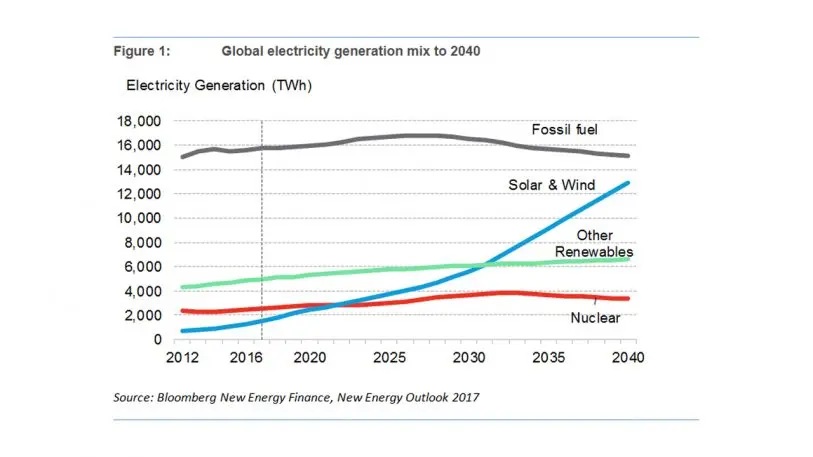

“Renewable energy sources are set to represent almost three-quarters of the $10.2 trillion the world will invest in new power generating technology until 2040, thanks to rapidly falling costs for solar and wind power, and a growing role for batteries, including electric vehicle batteries, in balancing supply and demand,” the report says. BNEF expects solar and wind to make up almost 50% of the world’s installed generation capacity by 2040, up from about 12% now.

Unlike coal, solar is a technology and technologies tend to get cheaper and more productive over time. The report foresees U.S. solar becoming 30% cheaper by 2022 and 67% cheaper by 2040. By contrast, the cost of coal will remain flat–and will thus see a 51% reduction in generation capacity in the U.S. by 2040, the report says.

Coal use for power will also plummet in Europe, and will only be partly offset by a growth in coal power in China and India. The report sees emissions from all energy peaking in 2026, and being 4% lower in 2040 than in 2016. That’s not sufficient to keep temperatures from rising above the internationally agreed 2 degrees Celsius threshold, however. For that to happen, BNEF says the world needs more than $5 trillion in additional clean energy investments.

The big question with renewables may not be their price, but whether electricity grids can handle their fluctuating nature. BNEF sees electric vehicles and battery storage playing a key stabilizing role, charging up when availability is high and prices are low, and then discharging when solar and wind aren’t as abundant. By 2040, the power stored in EVs will account for 12% of electricity generation capacity, becoming an integral part of our electricity infrastructure.

“This year’s forecast shows EV smart charging, small-scale battery systems in business and households, plus utility-scale storage on the grid, playing a big part in smoothing out the peaks and troughs in supply caused by variable wind and solar generation,” says Elena Giannakopoulou, lead analyst for the report, in a press release.

To be sure, the Trump Administration’s actions on climate and energy are regressive. But the consolation is that energy markets have their own momentum these days. BNEF makes its forecasts assuming that government subsidies will disappear over time. If they remain in place, or technology takes greater-than-expected leaps, the trajectory for renewables could be more favorable still.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.