On Monday in front of the New York stock exchange, Julia Steyn, head of General Motors’ urban mobility project, announced the company’s app-enabled car-sharing product, Maven, will now be more broadly available in New York City.

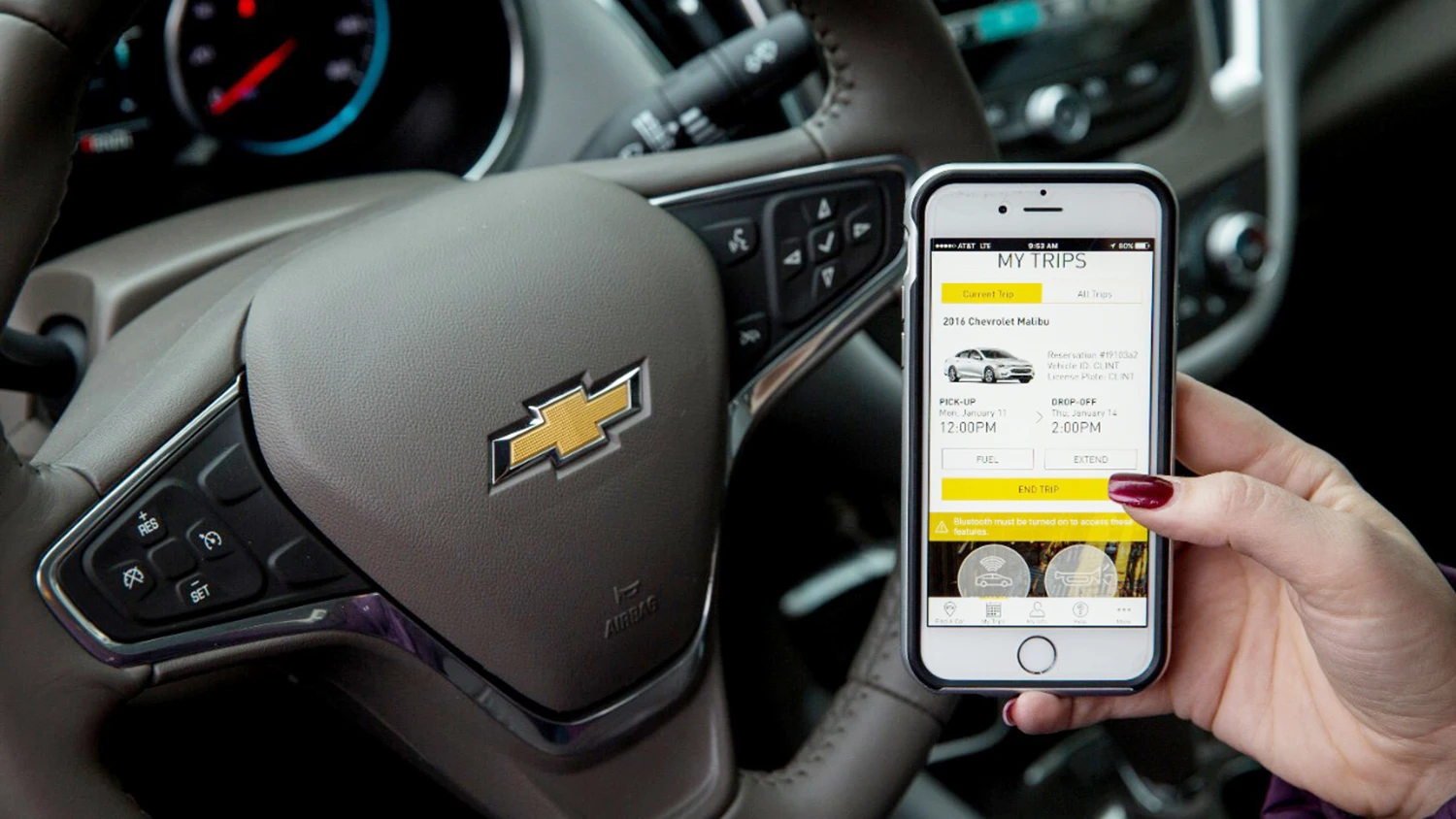

When the company first launched in the city, Maven was only available to residents of certain luxury buildings. The program has grown into more public garages, where anyone can rent one of 80 cars starting at $10 per hour.

Maven launched a year and a half ago and has since blossomed to 17 markets around the country, serving roughly 20,000 users, most of whom are around 30 years old, the company says. The platform is an attempt to get ahead of major changes coming to the automotive industry, like cars that can drive themselves without a human manning a steering wheel.

It’s not just the inevitability of self-driving cars that’s driving manufacturers to embrace innovation. Consumer preference seems to be slowly entering a new phase. Interest in car ownership appears to be waning, according to a 2016 McKinsey report. It notes that not only are a decreasing share of people aged 16 to 24 licensed to drive, but the number of car-sharing members (with companies like Zipcar) is increasing.

“Consumers prefer to consume transportation as a service,” Steyn posited as she spoke to reporters outside the New York Stock Exchange.

GM’s promotion of its foray into on-demand cars comes as many original equipment manufacturers, ride-hailing apps, and tech companies large and small are sussing out how they can be involved in the self-driving car market. Maven COO and former vice president at Zipcar Dan Grossman explained to me some of the advantages of being part of a car manufacturer in this burgeoning space.

For one, Maven pays nominal fees to use GM’s fleet and can repair cars quickly because it has access to GM’s dealership service infrastructure. Of course, Uber and Lyft don’t own any vehicles, which means neither incur maintenance costs. But not having their own vehicles also hampers their ability to test, develop, and iterate on self-driving technology. This matters more for Uber, because it has big ambitions to be one of the top self-driving technology companies. Lyft on the other hand is leaning on partnerships to explore putting autonomous cars on its platform (it has struck deals with GM’s Cruise unit and more recently Google’s Waymo).

Grossman also sees uniformity across Maven cars as a bonus from a user experience perspective–like walking into a Starbucks or McDonald’s, a person always knows what they’re getting. Since all the cars for rent are GM cars, they all have roughly the same feature set and build.

https://youtu.be/_v58NeEVFRY

Furthermore, this fleet of cars allows Maven to rent out to businesses as well as consumers. Among its rental offerings, Maven has commercially insured “gig” cars that it rents to people who freelance for services like Roadie, GrubHub, Instacart, Uber, or Lyft. That product is currently limited to the San Diego region, but will eventually come to more cities.

Finally, Grossman notes, the car-sharing program markets GM’s cars to users who may want to become car owners down the road.

From a point of profitability, he says it’s a matter of balancing a ratio of car members to trip length. The more miles or hours drivers typically use in a given market, the fewer overall drivers Mavens needs to turn a profit. Similarly, markets where drivers tend to borrow a car for shorter distances require a stronger user base in order for the venture to make money.

Maven, still in its early days, is not turning a profit. But Grossman is hopeful that Maven can prove an attractive option for longer drives and business travelers who need a car while they’re hopping from city to city.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.