From an early age, Credit Karma founder and CEO Kenneth Lin understood the value of money. He immigrated to the U.S. from China at age 4, landing in Las Vegas with his parents at a time when the booming desert town was defined by the rough glitz of craps tables and shrimp cocktails. His dad worked late hours, six days a week; his mom held multiple jobs and cooked for local bakeries.

“They were always starting something,” says Lin, 41. “I saw that growing up and I think in many ways it really influenced me.”

Lin took a steady job after graduating from Boston University–the first one in his family to complete college–but kept experimenting with business ideas on the side. First, in the early days of the World Wide Web, he bought computer parts at wholesale prices and built a website to sell them online. Later, he opened an internet cafe in Harvard Square.

“I like doing my own thing,” he says. “I like the challenge of thinking it through.”

But not until Credit Karma did he decide to tackle a challenge with a sense of mission rooted in his own childhood. Lin founded the company in 2007, with the goal of creating a customer-friendly alternative to trickster credit score services. He has since raised $386 million, vaulting Credit Karma into the ranks of Silicon Valley’s startup unicorns, and figured out how to turn a profit while helping nearly 70 million Americans discover financial services products that meet their needs. Perhaps it’s no coincidence that the company has become his most successful venture, by far.

“There are a lot of families struggling to make ends meet,” he says. “To the extent that we can help save $50 or $100–a month, a week, a year–that’s valuable. And we can make a business out of it, which is great. It’s hard to do both.”

For users, the product is simple: Create a Credit Karma account, and you can monitor your credit score for free. Based on your credit history, the company then generates targeted offers for financial services including credit cards, student loans, and auto loans. If you opt in to one of those offers, Credit Karma gets paid by a referral fee by the bank or lender–a new credit card customer, for example, could be worth as much as $700. In 2015, the company made around $350 million.

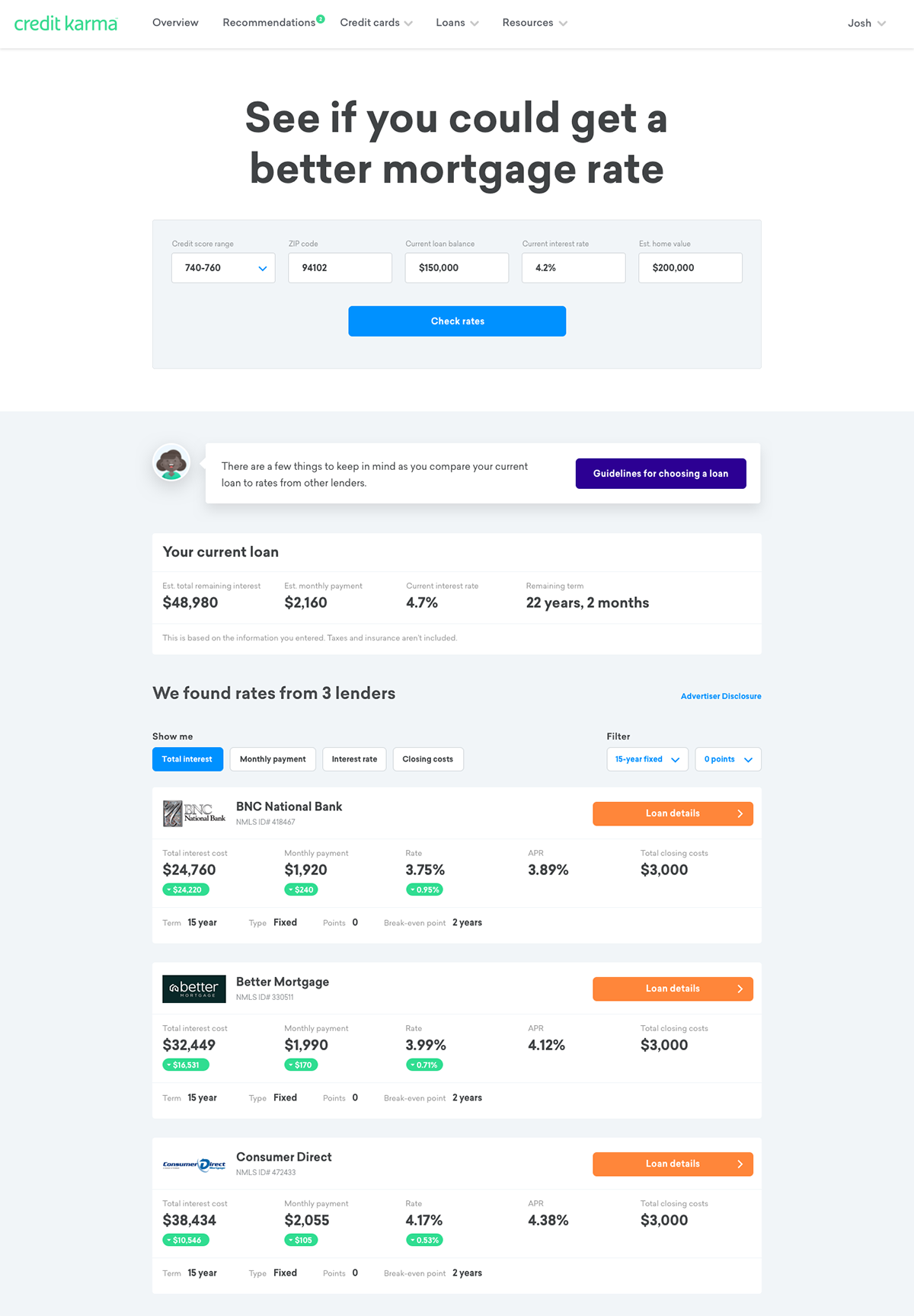

Now Lin is embarking on mortgage refinancing recommendations, Credit Karma’s second major launch in less than six months (a free tax service launched in January, in time for April 15 filing).

“We want to help consumers surface when they should refinance and have certainty around the money they are going to save,” he says. “Our goal is to make a refinance as simple as possible.”

The company is operating the service in 26 states, with plans to expand nationwide in the coming months. By Lin’s reckoning, 20% of U.S. mortgage debt is represented on the Credit Karma platform, and roughly one-third of homeowners would benefit from refinancing–a major opportunity. Down the road, Credit Karma plans to explore recommendations for related products, like home equity loans.

“The secret sauce of Credit Karma is relevance,” he says. “What we found is that the more specific you could get, the more apt people were to listen to your advice.” Mortgages will embody that precisely honed approach to targeting: “You’re not going to receive an email just because you have a mortgage. You’re going to receive an email if we have a high degree of confidence that you’ll benefit from refinancing.”

Layering in tax return data for users who file via Credit Karma will make the company’s degree of confidence in its mortgage suggestions even more robust.

Privacy, Trust, And Data

Credit Karma and other companies that rely on targeted advertising have their detractors–namely, privacy advocates. The company offers a classic internet-era bargain: trading personal data for a better deal or experience. A Credit Karma skeptic sounded the alarm on Reddit: “If you aren’t paying for a service, you are the product.” Online tax preparation service providers like Credit Karma are “thirsty for data,” the Wall Street Journal warned last month.

For Lin, this perception is a source of frustration. “People think we’re sellers of data. That’s wrong,” he told attendees at a conference in late March. “We protect the rights and privacy of our base.” The credit card industry as a whole still relies on direct mail campaigns that leverage data purchased from Credit Karma competitors. But on Credit Karma’s own site, banks and lenders don’t know that you’ve seen an offer for their product unless you decide to click through.

Long-term, Lin believes that Credit Karma’s success is tied to its ability to present itself as a trusted, independent advisor. “The consumer comes first,” he says. “I think that’s part of the discipline of doing this for 10 years. I don’t have to say, ‘we don’t do predatory loan products’ if the consumer is the thing that we orient ourselves around. At a lot of points of time we could have sold out or compromised the user base, but we didn’t do that. And it’s turned out to be a great investment, in addition to being just the right thing to do.”

Still, it’s a tricky balance; Credit Karma has no official definition of “predatory.” The company sometimes recommends LendUp, for example, a company that provides small-scale, short-term loans with APRs that can start as high as 400% (unlike a traditional payday lender, LendUp offers better rates over a time to borrowers who pay on time and in full).

“There’s a lot of dimensions,” Lin says. “We talk about this sometimes–what about payday lending, what about some of these other lending instruments where the typical consumer would say, well that’s bad. But what if you have really poor credit? You quickly realize, there is a group of people that are served by this.” He compares the socioeconomic norms of San Francisco, where Credit Karma is based, with the realities of his Vegas upbringing and the realities that many of his users face (based on Google search data, the company is most popular in Mississippi, Georgia, Alabama, and West Virginia). “It’s sort of Ivory Tower if you’re saying, ‘Don’t do this.'”

In that way and others, Credit Karma has evolved to reflect Lin’s values and perspective. He is frugal, for one. Back in 2012, before the company had raised its game-changing $30 million Series B, the team looked into running a TV ad spot as a way to attract users. When an ad agency estimated the total cost of creative, production, media buy, and analytics at around $500,000–roughly the same amount the company had left in the bank–Lin decided to take a more homespun approach. The company spent around $25 on props, recruited employees to be hand actors, and rented a budget recording studio to tape the voiceover. In the spot, a hand writes on a calendar, while a voice asks: “Did you forget to cancel your free credit score?” When it aired, registrations came pouring in. “We spent peanuts to acquire those users,” Lin says.

From Lean Times To IPO Rumors

He also embodies the work ethic he learned from his parents. As Credit Karma navigated the 2008 financial crisis, just a year after launching, Lin spent his days creating pivot tables to manage the company’s recommendations and his evenings emailing personal finance bloggers by the dozen. Three times, as the recession dragged on, Credit Karma nearly ran out of money, but on each occasion Lin was able to scramble and pull together a check or two (once from his own savings). He hired slowly, preferring to wear many hats rather than cycle through a startup boom and bust. Even today, chief revenue officer and founding team member Nichole Mustard says she has seen him pause and break down boxes at the office, to keep things tidy. “It’s still the right thing to do,” she says.

In a company’s early days, that form of leading by example can make the difference between success and failure. Now Credit Karma is at a different inflection point: It needs to find strong mid-level leaders and publish org charts and processes. Like many serial entrepreneurs, Lin does not take as naturally to this later, adolescent stage. “I think it some point I don’t love the full operations,” he says. “I like the thought component of [building a business]–I don’t like the bureaucracy.”

Given Credit Karma’s scale and profitability (it has been in the black for the last two years), IPO rumors have started to percolate. “It’s something we evaluate all the time,” Lin says. “It’s great to see Snap and everyone go out and have a great experience, because it creates optionality. But it’s never really been our end game.” His reservations center around “the ability to maintain the mission” and the ability to think long-term. “If we were a public company I don’t know if we would have been able to do tax. There would have been so much pressure to growth the business from a top-line perspective.”

Instead, for the time being, Lin is focused on his users–who skew young and will soon start growing into more and more financial products. Credit cards and lending products predominate now, but one day it might be brokerage accounts and life insurance offerings. “You’re going to see it go through the whole life cycle of everything financial services-related. We want to have a platform that’s smart, that helps you make the right life decisions around your finances.”

Down the road he envisions deeper integrations with bank partners, with the goal of making the platform’s “smartness” work better for users. It will be a lengthy process: “We have to understand how every bank and every product makes that decision; they have to share that with us. Then we have to know what the user preferences are. Then ideally there’s an integration where you don’t even have to apply,” he says. “Ideally that bank will say, great, approved. Here is a token that you can directly link into your Apple Pay wallet, you can start using [the funds] right now.”

Incumbents’ potential willingness to cooperate in such a scenario says a lot about the market opportunity that Credit Karma has been able to exploit. Faith in banks and other financial institutions remains low, even post-crisis. But within the Credit Karma brand halo, with its quirky voice and user-aligned business model, a specific bank product may look more compelling.

“We think finance shouldn’t be as serious,” Lin says. “But there’s a balance: You can’t be too irreverent or flip, because it’s people’s money.” At the end of the day, “We’re here to give people the tools to make the right decisions.”

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.