After footage of 69-year-old David Dao being forcibly dragged off a United Airlines flight bubbled to the surface of the internet earlier in April, customers cut up their United credit cards and swore to never again fly the airline. It’s stock lost $250 million dollars in value. The response to the United incident (and the #deleteUber campaign before it) is just the latest example of customers voting with their wallet–choosing to support or divest from a company with how they allocate their dollars. But the problem with voting with your wallet based on such incidents is that while they undoubtedly reflect something seriously awry within the company’s ethics, they don’t show the whole picture.

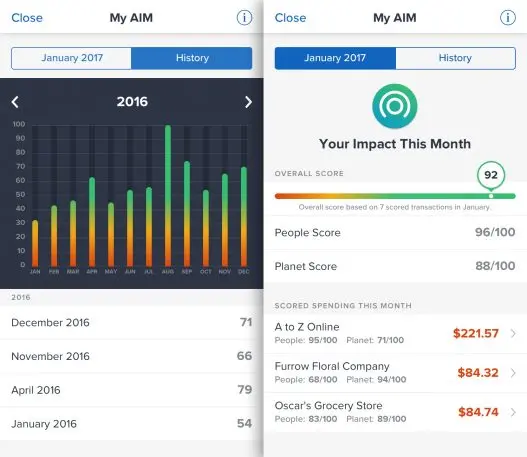

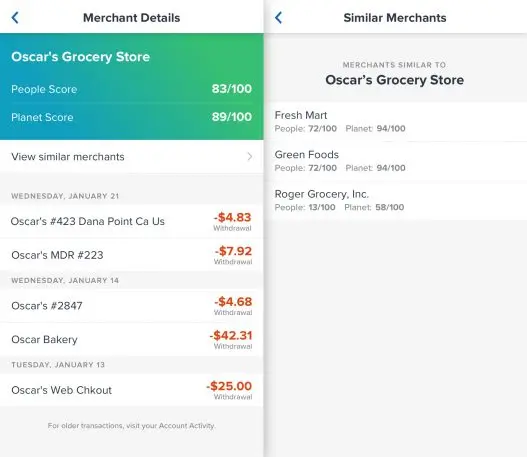

A new feature within Aspiration’s mobile banking app will go a lot further toward fleshing out the complete pictures of the places we most often spend our money. Called Aspiration Impact Measurement (AIM), the program analyzes not one, but thousands of data points to generate two scores for companies: The “People” score gauges how well companies treat their employees and communities, and the “Planet” score assesses companies’ sustainability and eco-friendly practices. Every time an Aspiration customer swipes the debit card associated with their account to make a payment toward a company, that company’s Planet and People scores are funneled into the customer’s personalized AIM score, which reflects the positive (or negative) impact of where they shop.

In the year-and-a-half since Aspiration launched, the financial firm has gained recognition for democratizing access to banking and taking an ethical approach to investing. The company offers a “pay-as-you-wish” model that allows customers to give Aspiration whatever amount they feel reflects the firm’s performance, including $0. Despite that, Cherny says over 85% of customers choose to pay, and Aspiration puts 10% of what it earns toward financing microloans for underserved populations, particularly immigrant women. And rather than funneling investments into projects like the Dakota Access Pipeline, Aspiration’s main investment product is the Aspiration Redwood Fund, which, Cherny says, skirts fossil fuels and firearms in favor of supporting companies with strong diversity profiles and environmental track records.

AIM is a concrete way to translate Aspiration’s “Do Well, Do Good” ethos into everyday consumerism. To create AIM, Aspiration worked with private data analyzers that dig into companies’ public reports and private data to craft an analysis of their practices, mainly for use by large hedge funds and investment firms. “We have contracts with those analysis companies, but instead, we’re taking that data and repurposing it for a consumer approach rather than an investment approach,” Cherny says. For 5,000 different businesses, Aspiration funneled their data into a proprietary algorithm that weighted all the different data points and sorted them into categories that build out the overall People and Planet scores. People, for instance, includes metrics like the percent of women and minority employees and the spread between CEO earnings and those of entry-level workers. In the Planet category are measurements like greenhouse gas emissions and the amount of waste sent to landfill.

For now, you’ll only be able to see the People and Planet scores of a company after you shop there, as a retroactive assessment of your purchase. In future iterations of the feature, Cherny says, customers will be able to research companies before choosing to shop there. But in AIM’s current iteration, the program will suggest similar companies after you’ve made a purchase, so you can start filing away data on businesses for future reference. This feature, Cherny says, “is maybe even more important than a company’s overall score because while currently, if you make a decision on where to shop, you’re looking at factors like cost and convenience and quality; now you can factor in conscience as well.”

This ethos, Cherny says, derives from his long career of working with politicians striving to make a difference: 20 years ago, he was with Al Gore at the White House as the then-vice president toured the country making speeches about climate change that nobody was listening to, and he worked with Senator Elizabeth Warren as she was starting to work for what became the Consumer Financial Protection Bureau. “A lot of that went into creating Aspiration, with the idea that if you founded a financial firm that was helping to drive sustainability and conscience, you’d be able to have a big impact,’ Cherny says. “And AIM is a manifestation of that: If people can start thinking about the impact of their daily spending on people’s lives and the environment, we can really force companies to start paying attention.”

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.