It might seem hard to believe but Nikki Sixx is fueling an important debate that will affect artists and musicians for decades to come.

Last month, the Motley Crue guitarist launched a campaign against YouTube, claiming that it pays “about a sixth” of what Spotify and Apple Music do. The Google-owned video site has neither confirmed nor denied this particular comparison, but it’s nevertheless gone on the defensive in a blog post written by its head of international music projects promising to “set the record straight.”

At no point in the post does Christophe Muller actively dispute the notion that YouTube compensates artists more poorly than its competitors. Instead, the argument he seems to be making is that YouTube shouldn’t have to compensate artists as highly as Spotify.

So are artists right that YouTube is paying them less than the Pandoras and Spotifys of the world?

And, as an ad-supported digital video platform where music is just one of its many verticals, is it unfair to demand that YouTube pay the same amount as Spotify?

Let’s take a step-by-step look at some of the claims made by both artists and YouTube.

Does YouTube underpay compared to Spotify?

There’s no standard per-song basis by which to compare YouTube’s royalties to Spotify’s royalties. While Spotify’s payouts can vary based on individual licensing agreements with labels, the company’s royalty payments are predominantly determined by two factors: whether the listener is a paid subscriber, and the artist’s overall popularity compared to the rest of Spotify’s catalog (in both cases the musician receives a greater per-song payout). YouTube’s payouts, on the other hand, are dependent on an enormous number of factors, including the number of times a video is played, the amount of time spent on a video, the number of subscribers an artist has, and even the number of comments on a video. Moreover, YouTube’s payouts can also vary based on licensing agreements, like the ones struck in partnership with Vevo to ensure that the world’s most popular artists, like Rihanna and Taylor Swift, host their videos on the platform. So while I’m sure Sixx is right that some artists get paid six times more on Spotify, the comparison is not so simple.

But while breaking down these numbers on a per-song or per-artist basis may be impossible, we can look at aggregate payout numbers.

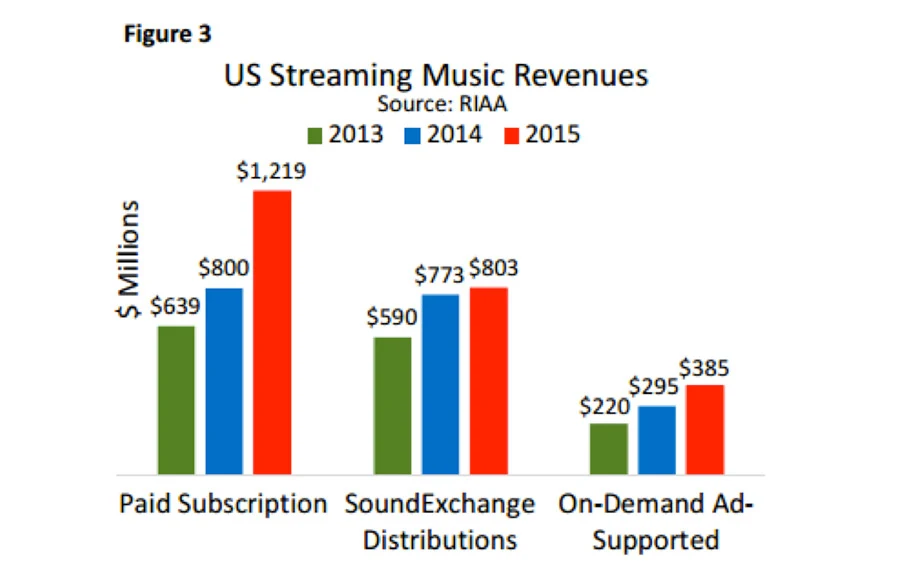

According to the RIAA, for the past three years straight, the largest percentage of U.S. streaming revenue came from paid subscription services—meaning Spotify’s paid tier, Apple Music, Tidal, and others—amounting to $1.2 billion in 2015. That’s a huge number, especially considering that the RIAA estimates that there were only 10.8 million paid subscribers in the United States alone, meaning that each of those subscribers paid the music industry over $100 apiece. (Which makes sense: That’s how much most paid music subscriptions cost a year).

Meanwhile, the smallest category was “On-Demand Ad-Supported” revenue, amounting to just $385 million. That’s the bucket into which YouTube’s proceeds flow, along with the ad revenue from Spotify’s freemium customers.

Now consider that YouTube has over a billion users worldwide, about 80% of whom come from outside the United States, amounting to around 200 million U.S. users. This means that 10.8 million Americans—most of whom were paying Spotify customers, though Apple Music is closing the gap—created over three times as much revenue as 200 million YouTube users (plus a few million Spotify freeloaders) did. That’s right: While Spotify’s paid tier and Apple Music net over $100 from each paying listener, YouTube nets less than $1.50 a listener.

So, in aggregate, Sixx is right: YouTube does not pay out as much as Spotify does. And again, YouTube doesn’t dispute that charge.

But YouTube suggests it shouldn’t have to pay as much as Spotify because it’s too different. Is that true?

In YouTube’s blog post, Muller writes, “The next claim we hear is that we underpay compared to subscription services like Spotify. But this argument confuses two different services: music subscriptions that cost $10 a month versus ad-supported music videos. It’s like comparing what a cab driver earns from fares to what they earn showing ads in their taxi. So let’s try a fair comparison, one between YouTube and radio.”

This is where things get tricky. YouTube is right that there are numerous differences between it and Spotify. But where the argument fails is when Muller tries to compare YouTube to radio. It’s an intriguing comparison for YouTube to make; after all, while terrestrial radio in the U.S. pays royalties to songwriters, it pays nothing to labels and performing artists, and so the fact that YouTube disbursed anything at all to these parties makes the platform look good by comparison.

But despite their differences, YouTube has much more in common with Spotify than radio—so much so that the RIAA classifies both YouTube and Spotify as the same type of service, while classifying only Pandora and directly comparative services as “Internet radio.” The key difference between radio and sites like YouTube or Spotify is that YouTube and Spotify both offer “on-demand listening,” meaning that users search for the content they want to consume and then boom: there it is. Radio, on the other hand, is pre-programmed—either by disc jockeys, algorithms, or corporate mandate—so users are to some extent “forced” to listen to certain songs over others. This is why radio is such a powerful promotional tool and why for decades radio stations have never compensated artists. Just being on the radio was compensation enough, many argued.

But YouTube wants to have it both ways: It wants to function like a paid subscription service like Apple Music, giving users a choice of consuming whatever they want whenever they want it, but it wants to monetize like an radio station: through ads. (Spotify is a little complicated because it has both a paid tier and an ad-supported tier. In addition, YouTube recently launched its own paid subscription service, YouTube Red; though judging by its lavish NewFront presentation it made to advertisers last week—where YouTube Red went completely unmentioned—the company is still very bullish on ad-supported models). The fact that advertising revenue still lags greatly behind subscription revenue—as illustrated in the chart above—is viewed by optimists in the industry as a temporary problem. The logic goes that as more and more ad inventory moves from terrestrial radio and television to YouTube, more and more money will be available to artists. Maybe this strategy will work. But it doesn’t change the fact that until that happens, many artists who are supplying YouTube with all this content will continue to feel the pain of a still nascent digital ad ecosystem—and artists don’t have a multibillion dollar parent company like Google to bail them out like YouTube does.

But YouTube isn’t just for music—it’s for all kinds of entertainment, right?

In the blog post, Muller writes, “The final claim that the industry makes is that music is core to YouTube’s popularity. Despite the billions of views music generates, the average YouTube user spends just one hour watching music on YouTube a month. Compare that to the 55 hours a month the average Spotify subscriber consumes.”

First off, I’d never heard the claim that Spotify users consume 55 hours of music a month. So I asked Spotify’s U.S. spokesman Graham James about it, and he said, “I have no idea where they got that metric.”

I did some digging, and it appears that the source for YouTube’s “55 hours a month” claim is an Ad Age article from 2013 in which then-Chief Sales, Marketing, and International Growth officer Jeff Levick said that “Spotify users average 110 minutes of listening time per day.” But again this was back in 2013 when Spotify only had a quarter of the users it has today. It stands to reason that as Spotify continues to scale toward mainstream acceptance, the “average user” is likely to be less of a music super-fan. In any case, more recent numbers from November 2015 show that Spotify users listen to 1.7 billion hours of music a month. With currently 100 million users, that comes out to be only 17 hours of music a month.

Even still, YouTube’s “one hour of music a month” is a far cry from 17 hours. But there are some reasons to question YouTube’s “one hour” claim. Skeptical of this figure, Digital Music News writer Paul Resnikoff did some “back of the envelope math” to estimate, based on this claim, what percentage of the content consumed on its platform is music. (YouTube couldn’t—or wouldn’t—tell Resnikoff how many hours the average user spends on the platform, but based on a few pieces of public information, he estimated that on average users spend around 80 minutes daily on YouTube. He then multiplied that number by 30 days to get monthly average listening minutes (2,400) and then divided it by 60 to get the monthly average listening hours (40).

So if we take YouTube at its word and extrapolate the limited data it provided using Resnikoff’s imperfect but convincing methodology, we find that YouTube expects artists to believe that only one out of every 40 viewing hours on YouTube is devoted to music—or a minuscule 2.5%.

That’s massively lower than the estimates made by just about every industry analyst, including AccuStream Research which, after digging deep into YouTube’s view counts, determined that 38.4% of all YouTube views are music. Regardless of the exact numbers, no industry expert I’ve spoken with argues that music isn’t the largest consumption category on YouTube.

So is YouTube lying about how many of its users listen to music? I’m not sure we can make those claims based on “back-of-the-envelope” math. But here’s a more empirical analysis: With this blog post, it would appear that Muller doesn’t believe that music is “core to YouTube’s popularity.”

But that claim is difficult to maintain when you consider that, of the top 30 most-viewed YouTube videos of all time, a stunning 28 of them are music videos. (The two outliers are wonderfully bizarre: the ninth most-watched video is a 54-minute compilation of nursery rhymes with 1.37 billion views, and the fourteenth most-watched is a Russian language cartoon called Masha and The Bear with 1.32 billion views.)

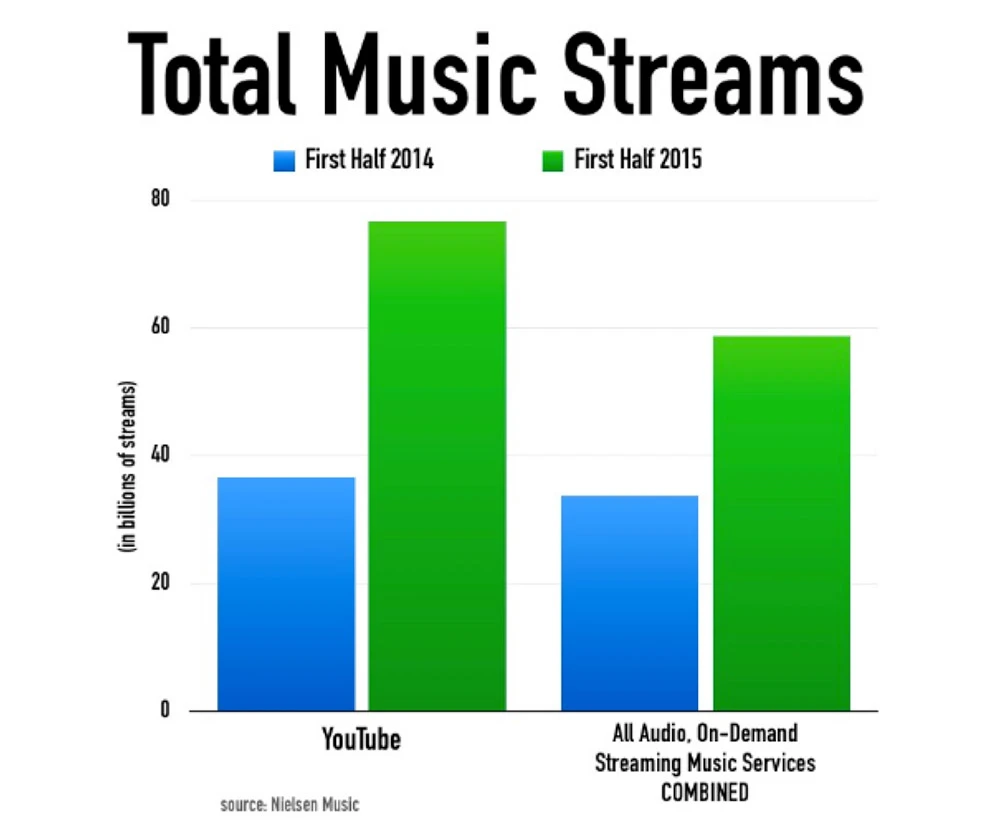

But perhaps the most compelling argument against YouTube’s attempts to separate itself from music-only services like Spotify comes in the form of data published last September by the reliably trustworthy analysts at Nielsen Music. They claim that in the first half of 2015, YouTube delivered 60% more music streams than all on-demand streaming music services combined—a figure that’s grown dramatically over the past year.

To be sure, no one party is fully responsible for the recent fight between artists and YouTube. If artists are going to host their music on YouTube, they need to be aware that doing so puts them at the mercy of an digital ad-supported model that is far from maturity. But for those conversations to be productive and intellectually honest, there needs to be more transparency about the numbers at the heart of the process.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.